New Era: Fractional Property Investment

New Era: Fractional Property Investment

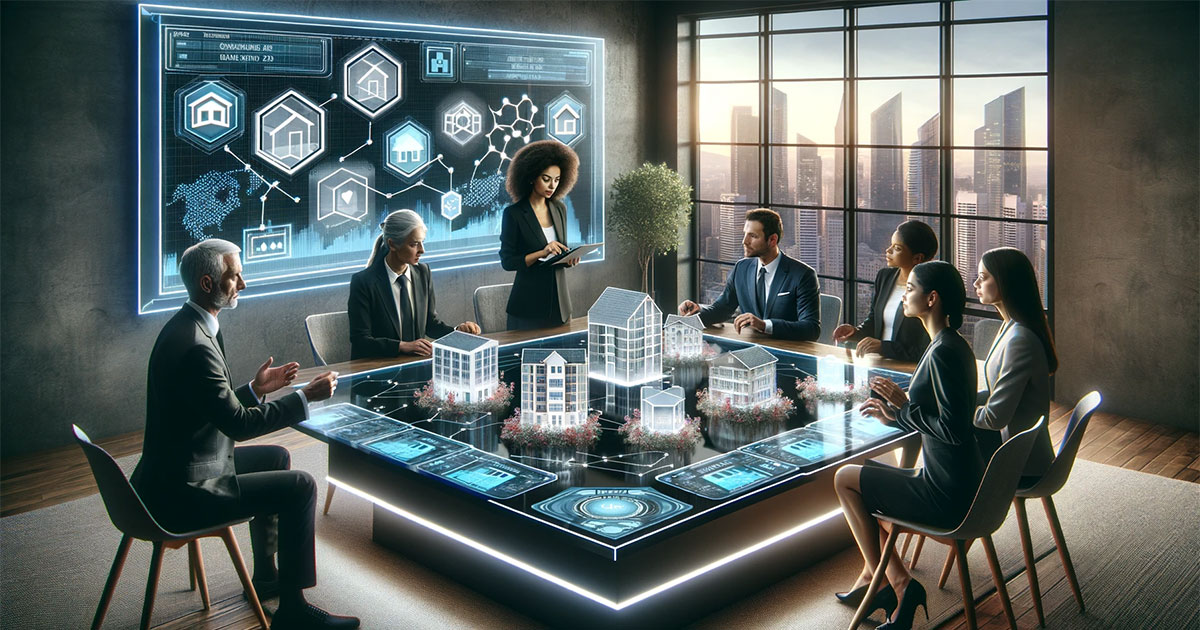

By exploring the emerging property trend of fractional ownership and tokenisation, blockchain technology is revolutionising property investment. This innovative approach is democratising property investment, allowing a wider range of investors to participate in the property markets. Particularly important for investors seeking portfolio diversification and sellers looking for new ways to attract buyers, this trend marks a pivotal shift in the dynamics of real estate. It embodies the intersection of technology and investment, presenting unique opportunities and challenges for the property sector.

The rise of blockchain in real estate

Blockchain technology is transforming various industries, and real estate is no exception. Best known for underpinning cryptocurrencies such as bitcoin, the technology is now facilitating fractional ownership of property. By tokenising property assets, blockchain allows these assets to be divided into smaller, more affordable shares. This process not only simplifies the transaction, but also opens the door for a wider range of investors to enter the property market.

Democratising real estate investment

Fractional ownership is not a new concept, but blockchain technology increases its accessibility and efficiency. Traditionally, investing in real estate has required significant capital, limiting the pool of potential investors. With blockchain, however, even those with modest means can invest in real estate. This democratisation of real estate investment allows a more diverse group of participants, including small investors, to benefit from real estate investment.

Benefits for investors and sellers

For investors, fractional ownership via blockchain offers the opportunity to diversify their portfolios with real estate, which is traditionally a solid investment. It lowers the barrier to entry in terms of capital requirements and provides greater liquidity compared to traditional property investments. For sellers, this trend opens up a new market of potential buyers. By offering fractional ownership, sellers can attract investors who previously could not afford to invest in property, potentially increasing demand for their properties.

Practical applications and real-life examples

Real-world applications of blockchain in real estate are already emerging. For example, platforms such as Propy are experimenting with the tokenisation of real estate, allowing users to buy and sell properties through blockchain-based transactions. Similarly, projects like the Bahamas Smart City are exploring the use of blockchain for real estate investment. These examples demonstrate the practical viability of this technology in transforming real estate transactions and ownership.

Implications for property investors and working with estate agents

For potential property investors, the advent of blockchain and fractional ownership represents a significant opportunity. It makes it possible to invest in property with less capital and offers a new way to diversify portfolios. For estate agents, understanding this trend is crucial, as it has implications for how properties are marketed and sold. Working closely with an estate agent who understands blockchain and fractional ownership can provide investors with the guidance they need to navigate this new landscape in property investment. This collaboration can ensure that investors make informed decisions and capitalise on the opportunities presented by this technological advancement.

Joe Gayer, Beatriz Velasquez

Lokation Real Estate

1500 E Atlantic Blvd Suite B, Pompano Beach, FL 33060

Email: 411joe@gmail.com

Phone: (954) 224-3140, (561) 706-2070

I take the time to listen carefully to understand my client’s needs, wants and concerns. I will be ready to take quick action when required and spend more time with those who aren’t quite sure which direction to take. My genuine concern for my client’s best interests and happiness ensures the job is done!